Dental, Vision, and Critical

Critical Illness

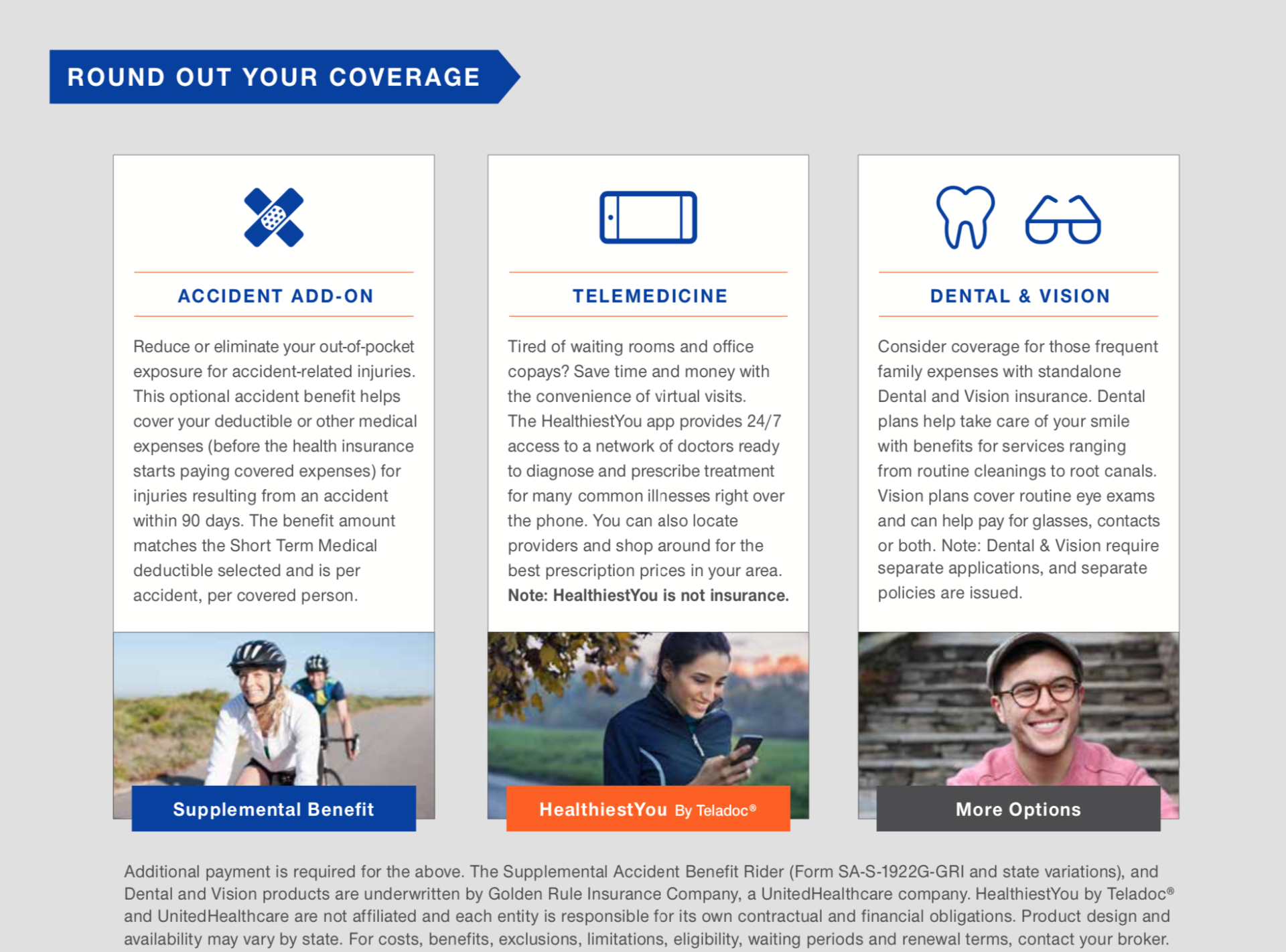

Ease the burden of meeting a deductible in the event of an unforeseen sickness or injury by securing Accident and Critical Illness supplemental products

Cancer, heart attack, stroke…all major medical illnesses that can be overwhelming and frightening. When such an illness occurs, it can be difficult enough just dealing with the diagnosis, follow-up care and recovery. Worrying about the financial challenges caused by the illness only adds to the burden.

H.I.F.E offers a simple way to ease the financial burden of mounting medical bills and the potential loss of income in these situations with our Critical Illness Insurance.

How the Critical Illness Plans Work:

Critical illness insurance coverage pays a lump-sum benefit upon diagnosis of certain specified medical conditions. The financial assistance from a critical illness policy can help you focus on recovery.

Benefits can be used however you wish, including:

- Supplementing your health insurance

- Paying your mortgage or other bills

- Getting personal home care

- Taking time off from work

- Paying for child care

Dental Coverage

Need braces or major dental work right away? United Healthcare has you covered.

Vision Coverage

Life Insurance

While getting your health insurance, protect your loved one with United Healthcare’s Term Life Insurance product. Ask your agent for more details.

GUARANTEED ISSUE LIFE INSURANCE

With the tough economic times these days, it’s easy to think, “Maybe I don’t need a life insurance plan right now.” In reality, maybe you need one now more than ever before.

Life Insurance in Today’s Economic Environment

If you’ve been putting off buying life insurance because of the cost, you may not realize that there’s an affordable alternative to expensive life insurance, (guaranteed issue life insurance). There’s no need to leave those who depend on you without protection. Guaranteed issue life insurance provides an affordable opportunity to give your family the financial security they need.

Benefits of Guaranteed Issue Life Insurance:

- The simplest and most affordable type of life insurance you can buy. Death benefits are tax-free to beneficiaries. Offers an affordable way to cover debt obligations such as tuition, mortgages, bills and more. Premiums remain the same for the entire length of contract.

Tailored to meet your needs:

- You choose the amount of coverage: $10,000 – $500,000.

- You choose the term: 10, 15, 20 or 30 years of coverage. Simple to understand, simple to apply…no medical exam required!

- Simplified underwriting…just answer 6-8 “yes / no” questions.

Approval process takes 10 minutes!